The Financial Knowledge to Navigate Your 20s

I read 10s of finance books so that you don't have to. Hear out my blueprint for planning your 20s and get the most out of your life on the way to financial freedom.

I started working at the young age of 19 years. As a kid growing up in middle-class India, this is not a common occurrence. The fact that it was paid work which I received real money for makes the feat even rarer given the piss-poor scenario of the unpaid internship-laden market nowadays.

It's not like I had a choice, though. Losing both my parents at a young age and being raised by my retired grandparents who spent whatever little savings they had solely on my education forced me to quickly become sincere regarding making money and elevate my living standards to support the people who mattered to me the most. So I tried doing whatever paid work I could find while I was pursuing my college degree and while often the pay wasn't much, I did whatever little I could to support my family or at least make sure that I never had to bother them for any of my personal needs.

Today (2024), I have reached a reasonably comfortable position financially, working a software job at one of the top-paying MNCs in the world. While initially the reason for pursuing money was to just meet my bare minimum needs, Over time my reason for giving importance to money has changed. It's no longer an instrument for buying comforts, it's an enabler of freedom.

Why You Should Care About Financial Freedom

While I know that some of you might think happiness can't be bought with money, freedom can. And I am really happy when I am free. Freedom means having enough money to take a 2-hour flight when you'd otherwise have to travel 36 hours in a train. It means being able to skip the crowd and get the most comfortable seat at your favourite artist’s concert.

While my hourly income (yes, It's important to think of money by measuring against the time you spent to earn it) has increased over the years by manifolds, being the analytical over-optimizer I am, I have of course gone ahead and watched tons of videos1 and read a bunch of books2 about how I can grow my wealth further. After all, It's not about how much money you earn, it's about how much you keep. Over the years ranging from 2019 to the present day, I did my research, followed friends' advice, invested in broadly respected as well as questionable assets, made some profits as well and lost it all a few times.

But over time I developed a blueprint which in my belief is the best strategy someone in their 20s can follow to end up with a moderate (good enough to last you for the rest of your life) to crazy big (don't want to sound cliché, but imagine the kind of people who have a different supercar for each day of the week) nest-egg for you to peacefully ride with into your golden years.

A Note on Financial Instruments

Before I give you the financial blueprint I have in mind, we first need to set some context. Note that I am not someone who is an investor or trader by profession (And I am assuming most of the people reading this are not as well). I have a job unrelated to finance, a social life and interests other than perpetually thinking about how to increase my bank balance. So for all novices like me, here is a quick refresher on different financial instruments and the fundamental commonalities between them.

Through all the books and media I consumed, I realized that in any country, the ways of growing wealth as a working-class member of society are fairly fixed with predictable rates of returns and taxation. Some instruments might be region-specific (for example 401Ks in America or Post Office Monthly Income Scheme in India), but generally approximate equivalents can be found in most other countries (for example EPF in India is similar to 401Ks in America).

Then there is the distinction between the different instruments based on where a certain instrument derives its inherent value from. Is it Debt-based (meaning the instrument involves someone borrowing money from you to be repaid later, with interest) or Equity-based (involving raising money by selling shares in a company)? Then there are also instruments which might be a mix between the two - and the shift in the ratio (more emphasis on debt or more emphasis on equity) sprouts further variations.

But the key thing to keep in mind from the above discussion is that completely radical and fundamentally different financial investment opportunities are rare to come by (For example, the launch of Bitcoin in 2009 which kicked off the cryptocurrency movement). Every financial instrument otherwise tends to follow a simple rule of thumb - you give someone (generally a company or a government) some money and that in turn puts you at a certain amount of financial risk, in hopes of that money being magnified and returned to you at some later point.

Hence, a mental model I have is - given the limited novel investment opportunities (ignoring minor fluctuations between different providers and transient market trends), I see diminishing returns on the overconsumption of media regarding finance. The bigger problem for me is possibly reading too much about this stuff which may cause me to get greedy and chase bad or risky ideas and investment tips, which will end up doing more harm than good.

The Only Blueprint You Need to Follow

The path that I speak of is well-defined and also gives you a reasonable amount of surety that you don't lose the money you end up saving overnight by an accident or a disaster. I like to think of the path to financial freedom as three ordered and non-overlapping steps. Ordering matters here. You only move to the next step once you complete the previous one.

Step 1: Insure

No matter how hard you work to make money, there are some events and risks in life which have the potential to wipe out all your savings and even push you into debt. Stories of people developing chronic diseases or meeting an accident which forces them out of work are not unheard of. And while it’s good to have an optimistic viewpoint towards life, the costs of insuring invaluable things like your health, life and house are laughably low at times and make you tension-free about having to dip into your funds when accidents strike.

I am not sponsored to say this, but you can consider talking to my good friends over at PrishaPolicy to assess your risks and the resulting insurance needs.

Step 2: Secure

However not all risks can always be insured. For example, employment is not guaranteed, and many countries don't offer reasonable insurance products for the loss of jobs.

Another example is the transient dips in equity markets. If the stock market collapses tomorrow, and you find yourself in a pinch you will be forced to sell your positions at a much lesser price, without being able to tide through the bad time without selling your assets.

At this point, you will start having to self-insure for risks which aren't covered under insurance policies. This is where the concept of emergency funds comes in.

An emergency fund is the money you keep in liquid form (cash, FD's, etc.) which can be immediately sold off or traded for emergency situations not covered by insurance, or when you lose all your sources of income and now need extra funds to meet your fixed recurring expenses. The rate of interest on the emergency is of little importance as long as it beats inflation. Liquidity is the most important factor while deciding on the instrument for cultivating an emergency fund.

The reason for buying insurance before building an emergency fund is simple. For most young people, the amount needed to buy an annually renewed insurance policy is generally much lower compared to the money needed for an emergency fund. Also, if an unlikely disaster strikes, for example, a health issue, it can wipe out most people's emergency funds in days.

Step 3: Magnify

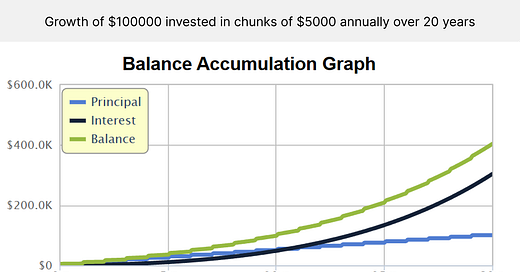

With the previous two steps out of the way, we can now freely think about how to grow our wealth to secure a comfortable life for us and our successors. When we are young we have a huge opportunity and an advantage over others - the advantage of time. We tend to underestimate the effect of compounding and the greatness we can achieve by just small improvements on a continuous basis. Compound interest is the key player behind any strategy for growing wealth.

Aided by the powers of compounding, I see two key ways to magnify wealth -

Compound interest on monthly savings (recommended)

Compound interest on front-loaded gains (more powerful)

The Fork in the Road

When we talk about financial goals, most people aim to live a comfy enough life in their younger years and then save in hopes of retiring at somewhere around 60–65 years of age. You basically grow your net worth till 60 to 70 years of age and then start seeing dips in it in subsequent years as you replace your recurring income with money from your nest egg. I encourage you to read Die With Zero for a better alternative to this traditional path.

In order to accomplish the above-mentioned approach number 1, i.e. Compound interest applied on top of monthly savings, is more than sufficient and what most people aim for.

Compound Interest on Monthly Savings

Consistently investing each month tends to have a cost averaging effect. Some of the months (when the market is bullish), you'd be buying fewer stocks for the same price and buying more when the market has a lot more sellers than buyers.

Also, your ability to invest tends to increase over time as your income increases (provided you haven't increased your living standards disproportionately with this increase in income). Over the long term, instruments like stocks and equity funds (index funds in developed stock markets tend to give comparable returns to mutual funds for many market segments with much lesser fees, but that's going into too much detail) can give 10 to 20% CAGR, which is good enough to plan for retirement for most folks.

The problem is excessive marketing of stocks and mutual funds in the last decade along with ease of investing has made youngsters jump the gun and dive into these without paying attention to the previous two steps (insure and secure). Almost all people my age who I meet today have more invested in stock markets with little to no liquid and fixed growth deposits. But this essentially means having to rely on parents and credit card debt during rainy days or when the market is doing horribly, something which I am not in favor of doing.

You can use the financial instruments I mentioned so far (there are many more) as per your risk appetite, and constantly pump whatever's left after your expenses each month into them. The general advice which is given here is - for short-term goals like marriage or buying a car, go for fixed return style assets (like arbitrage funds) and for long-term goals, slightly more risky assets are better suited like stocks and mutual funds. As your goal horizon increases, you are expected to make peace with risky assets intermittently taking a turn for the worse and then restoring back to normal or higher levels with the belief that ultimately in the long run, your money will grow (and practically speaking, it does tend to grow at much higher rates than fixed income assets over extended periods).

Compound Interest Applied On Front-loaded Gains

Sure, compound interest can turn a dollar into millions given enough time, but how much time do you have? Will you enjoy your wealth as much when you are older? What if you die? In the compound interest argument, often the thing which goes understated is the unfair advantage starting with a bigger principal amount (the amount you start with early on) can give you. If you missed the chart I added in the previous section, go check it out again. The difference created by front-loading is huge, and only widens year-on-year. Incremental investing just can't keep up with front-loading if everything else stays the same.

And this is essentially the advantages which something like entrepreneurship or having your own business provides. You essentially front-load your effort and time to generate large sums of money in a time much shorter than what average people take (often their whole careers) which then allows you to employ the powers of compound interest on a much larger base starting point, and that's what gives you the filthy richness later on. This is the core concept behind the "Fastlane Way" popularized by author MJ Demarco in his book "The Millionaire Fastlane".

It's fine if you don't want to be filthy rich, as long as you are not hoping that a 9-5 and compounding alone will get you there.

On the flip side, if your goal is to reach the pinnacle of financial freedom, I would highly suggest you consider your options and evaluate if the path that you are currently on will actually take you to your desired destination.

Conclusion

No matter what your decision is regarding the final fork in your road to financial planning, the first 2 steps of the blueprint ensure that you don't completely endanger yourself at any point.

Doing the first two steps well might even give you the courage to take the plunge and take up entrepreneurship. Having the correct insurance and a big enough emergency fund will give you the confidence that you can survive for months or years, even in perilous circumstances. If you don't have insurance and emergency funds in place, your number one priority should be getting these in place.

I hope you found this brain dump useful. If you have any further questions, feel free to contact me on Linkedin or X. You can also book a free call to discuss with me whatever's on your mind and see if I can help you in any way.

Some of the good finance YouTubers from the top of my head:

Some of the books I consumed on finance: